T: 01822 851370 E: [email protected]

Visit RSN Survey about life in rural England to find out more.

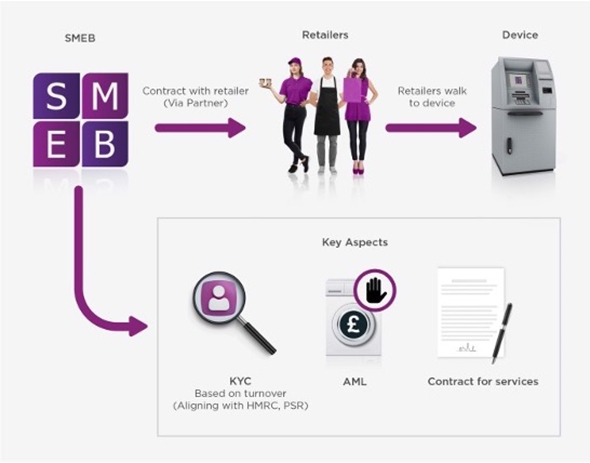

Cash Solutions for rural businesses with SMEB Cube

Bringing cash services back to rural communities is what SMEB is undertaking with its payment Cube.

Bringing cash services back to rural communities is what SMEB is undertaking with its payment Cube.

Local businesses can sign up to the service and as the Cube is designed to be in a safe and convenient place it’s easy for businesses to place their cash and daily takings in a secure location. Once cash is counted and checked for fitness, the funds are assigned to the recipient’s business bank account within 24 hours.

Cash solutions made simple with SMEB |

Idea for the SMEB Cube

Access to cash is a big issue and the initiative for the SMEB Cube came about as a result of the 6,000 plus banks leaving the UK high street making it difficult for small businesses to find a safe and secure location to place their cash takings. The Cube provides a cost-effective solution for businesses and helps with the access to cash issues facing many communities.

Ask for a SMEB Cube in your area

If you would like a SMEB cube in your area please submit your postcode using this link (you won’t be asked for any personal details). When 15 businesses sign up in your area, a convenient location for a go-live place will be found where we can activate our Cube facility.

SMEB’s mission

SMEB’s mission is to give small businesses the tools they need to develop and grow their business, whether that be through our digital payment options, or cash products.

SMEB is authorised, regulated and connected to open banking

SMEB is an Approved Payment Institution that can accept cash being placed by UK SMEs. SMEB is also a principal member with VISA and Mastercard through their licensing programming.

SMEB has also built connectivity to the UK Open Banking environment and has access to 3,500 EU Banks for Open Banking services, allowing us to offer a full range of bank payments (including cash).

If you’d like to know more please visit the website at www.smeb.co.uk or email [email protected] to find out more.